It’s expensive and there are so many more things you’d rather spend money on than auto insurance, but if you get pulled over or in an accident, the officer is going to ask for three things: License, registration and proof of insurance.

If you are caught driving without insurance in Tennessee, you may be charged with a Class C misdemeanor, which can result in fines or a suspended driver’s license requiring an SR-22 form to be reinstated. Ignoring the law to save money could end up costing you a whole lot more.

Since 2017, uninsured drivers in Tennessee will pay fines and risk losing their vehicle registration if they are unable to demonstrate proof of financial responsibility. A web-based program will verify insurance for all Tennessee drivers. These changes come as part of the James Lee Atwood Jr. Law.

tngov.com

If you are involved in an accident while uninsured, your charge will be bumped up to a Class A misdemeanor. Penalties for driving without insurance can include:

- A fine of $300

- The revocation of your driver’s license until you:

- Provide proof of insurance, and

- Retake and pass your driver’s license examination

- A restoration fee of $65 to get your license back

- A $50 fee to be paid to the commissioner of safety

- The requirement to provide proof of insurance with an SR-22 certificate for three years

Despite these consequences, about 20% of all motorists in this state are driving uninsured vehicles. This is much higher than the national rate of 13%.

In the state of Tennessee, your car insurance policy must include the following:

- Liability insurance: This covers injuries and damage you may cause to others if you are responsible for a collision. You must have at least the following amounts of coverage:

- Bodily injury liability coverage: $25,000 per person / $50,000 per accident

- Property damage liability coverage: $15,000

- Uninsured motorist insurance: This covers your injuries and property damage if you are in an accident caused by an uninsured, underinsured or hit-and-run driver. You must have at least the following amounts of coverage:

- Bodily injury coverage: $25,000 per person / $50,000 per accident

- Property damage coverage: $15,000

In addition to the mandatory coverage, most car insurance providers offer a variety of coverage options that you may want to consider. These include:

- Collision coverage: This covers collision-related damage to your own vehicle, regardless of fault. Pays to repair or replace your car if it is damaged in a collision with another vehicle or a stationary object. It can also cover you if you overturn your vehicle while making a sharp turn. It is often required by lenders until you have paid off your vehicle.

- Comprehensive coverage: This covers non-collision-related damage to your own vehicle if it is lost or damaged due to an event such as a falling object, flood, structure fire, hailstorm, or property crime including car theft. This is also typically required by lenders until you have paid off your vehicle.

- Medical payments coverage aka Personal injury protection (PIP): This provides coverage for your own medical bills if you (and your passengers) are injured in an accident, regardless of fault.

- Towing and roadside assistance: This covers the cost of assistance if your vehicle becomes disabled while you are out on the road, such as if your engine overheats or you get a flat tire.

- Rental car reimbursement: This can cover the cost to rent a vehicle while your own vehicle is being repaired following a covered event.

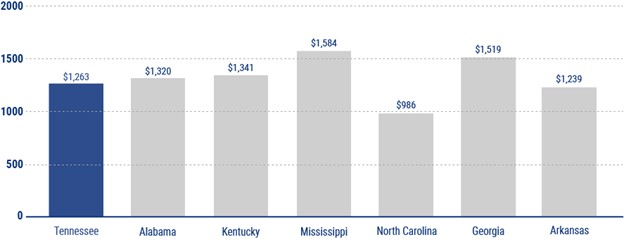

Average Cost of Car Insurance Per Year

Vehicle owners in Tennessee pay an average of $1,186 per year for their auto insurance coverage. This is lower than the national average of $1,311. Your actual quoted price for coverage will be calculated based on factors such as the make, model, trim, and year of your car, and even personal details like your driving history, age, occupation, and credit score. Comparing quotes from a variety of insurers lets you be sure that you are getting the coverage you want at a competitive price.

Car insurance policies in Tennessee generally follow the car rather than the individual. For example, if you get in a car accident while driving a friend’s vehicle, the primary source of the compensation would be your friend’s auto insurance coverage, not your own.

Tennessee is not a no-fault state.

This means that if you are in a collision, the person responsible for the accident is responsible for covering any resultant property damage and necessary medical treatment. If the at-fault driver does not have enough insurance to cover the costs, they will be expected to make up the difference out of pocket.

In no-fault states, your own insurance policy provides the first line of coverage for necessary medical treatment, regardless of fault.

FACTS

TN averages 190,636 vehicle accidents every year.

Of these, approximately 143,300 involve property damage, and 46,400 result in injuries.

The average cost of a collision in Tennessee is $13,561.

Tennessee drivers collect about $2.49 billion in insurance claims per year.

from https://www.tnindependentagents.com/car-insurance-tennessee/

Tennessee SR-22 Insurance Documents

When seeking to reinstate your driver’s license after being convicted of a DUI, driving without insurance, reckless driving, or another driving violation that results in a suspension, you must file a SR-22 insurance document. This form gives proof of future responsibility, and you might need to have it for five years from the date of the suspension.

According to the Tennessee Department of Safety and Homeland Security, if you file the SR-22 for a total of three years within the five-year period, the SR-22 might be canceled. If five years pass from the date of the suspension before you reinstate your privileges, then you don’ need to file the SR-22. If you cancel the SR-22 before the required time passes and you fail to file a new form, your driving privileges remain suspended.

Your insurance provider may be able to electronically file the SR-22 insurance documents. That way, you can get back on the road quicker, though with a little less cash in the bank.