Disclaimer: I am not an expert or trained in any way to instruct others. This is purely my experience of studying for and acquiring my licenses in Property, Casualty, Life, Accident & Health this past spring.

I went overboard in my preparation for the licensing exams because I was nervous and had the time to study as much as possible. I am not a fan of multiple choice tests as I tend to second guess my answers, so wanted to learn and build my confidence. If I failed, I knew that I could take the test again but who wants to rely on a redo? Not I. My degree is in English Literature and I’d been a stay-at-home mom for 18 years after a brief career in television production. My dad has been a life insurance salesman for over 50 years, but I can’t say I picked up too much from him and felt that I was truly starting from scratch.

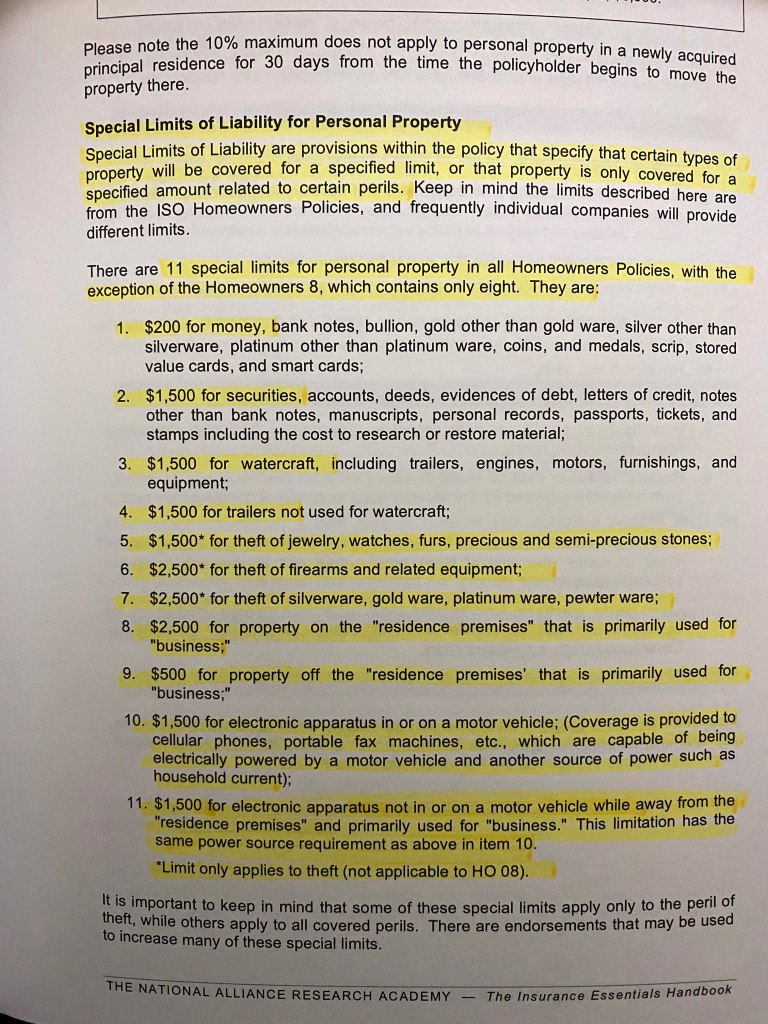

I completed online training through WebCE at home in December and January. The basic program worked well for me. You don’t need the extra stuff they offer (workbook, flash cards, etc.) unless you feel like spending more or you prefer paper to a screen. Speaking of, check for a promo code or a coupon for the course. You can go at your own pace and take unlimited practice tests that simulate the exams. The questions are different, but you’ll get a feel for the wording. Much of it is common sense, so learn the basics, vocabulary terms, and focus on state regulations and specific numbers, such as days and dollar amounts. How much is the penalty for breaking a law, how long do you have to change address after moving, in addition to insurance principles.

The courses are 20 hours, which could be more or less depending on the individual. You may start, save progress and return, so long as you finish within the allotted time period (a matter of weeks). You definitely don’t want to have to pay for the course again, so start when you’ll be able to complete it and then you have three months (I think) to take the official exam after completing the precertification. Taking the test as soon as possible, while everything is fresh in your mind, is ideal. I managed to take all four just before COVID-19 wreaked havoc, thankfully.

I heard the classroom sessions are like watching paint dry, but Kaplan offers that option and you may learn better in that environment or want more human interaction. I found that YouTube videos by a man named Lauren Myers were the most helpful for P&C test preparation, actually. He has a way of cutting through the confusion that sticks with you.

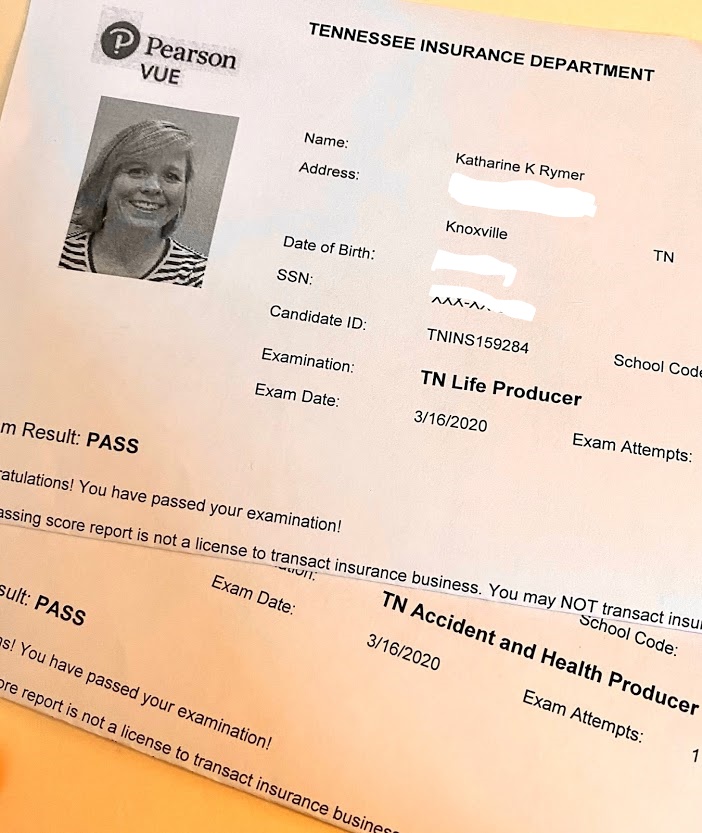

Through whichever program you choose, pass the final exam in each division—in my case, Property, Casualty, Life, Accident & Health—and print the certificate(s). Now you’re ready to register for each test at Pearson Vue Testing Center (or a different location). They combine P & C and Accident/Life so you may take two tests back to back (about 30 minutes/120 questions each). Again, check for a promo or a two-for-one deal. You need to score a 70 or above and they will print the result immediately after: Pass/Fail only. The proctor on my test day tried to “Regis” me and act like he was handing me bad news. Not nice!

You should be prepared for a seriously thorough shakedown upon arrival at the testing center. You aren’t strip-searched, but that’s about where it stops. Pockets are emptied, hairstyles are inspected, glasses are checked, mouths opened, and everything you brought with you goes into a locker. Nothing goes into the room with you except your locker key and a provided pad and dry erase marker that is returned and checked after the test. Don’t even think about going to the restroom or else go through the inspection again. The center tests for all sorts of licenses, not just insurance, so they are discriminating. Everyone is equally suspected of trying to cheat.

An applicant who has committed a felony of the first degree, a capital felony, a felony involving money laundering, fraud, or embezzlement, or a felony directly related to the financial services business is permanently barred from applying for a license.

Once you pass, you must apply with your state’s insurance department and pay the applicable fees. Tennessee has a $50 filing fee for each line. You will need to submit to a background check including fingerprinting and await the decision, which for me, meant receiving my certificate in the mail a couple of weeks later. I knew I had a clean background check, but it’s kind of like passing a police cruiser on the interstate, I felt relieved anyway.

The following is the official general requirements from the state of Tennessee.

An “Insurance Producer” is a person required to be licensed under the laws of Tennessee to Sell, Solicit or Negotiate insurance.

General Requirements

- The applicant is at least eighteen (18) years of age.

- Resides in Tennessee.

- The applicant is competent, trustworthy, financially responsible, and has a good business reputation.

- The applicant is required to pass a written examination and complete a prelicensing course of study thru an approved education provider for each line of insurance for which an insurance license is requested. Such course of study must consist of the following minimum number of hours. Approved education providers can be found at Pearsonvue.com.

Lines of Insurance / Number of Hours

Life / 20

Accident & Health / 20

Property / 20

Casualty / 20

Title / 20

Personal Lines / 20

Application Procedure - Complete prelicensing education requirements through an approved prelicensing education provider for the line(s) of insurance for

which you wish to be licensed (Provider will complete prelicensing certification.) - Schedule your examination with PearsonVue. (Phone: (800) 274-4957)

You must present your Prelicensing Education Certificate at the exam site on the day of examination. - Fingerprint based background check is required — see attached instructions.

- Pass the required examination. PearsonVue will electronically submit your scores to the department.

- Submit your application and filing fee ($50.00) to the TN Department of Commerce and Insurance electronically at http://www.nipr.com

OR file the paper Uniform Application. YOU MUST WAIT 48 HOURS FROM TAKING THE EXAMINATION TO SUBMIT YOUR APPLICATION ELECTRONICALLY. Processing time for paper applications is 15 days from receipt in the Agent Licensing Section. - You will be issued a license by the Tennessee Department of Commerce and Insurance once you pass your examination and the Department of Commerce and Insurance is satisfied that you meet all other licensing requirements. THE TENNESSEE DEPARTMENT OF COMMERCE AND INSURANCE MAKES THE FINAL DECISION AS TO WHETHER TO LICENSE ANY APPLICANT UNDER TENNESSEE INSURANCE LAW.

An insurance producer shall not act as an agent of an insurer unless the insurance producer becomes an appointed agent of that insurer. The appointing insurer shall file within fifteen days from the date the agency contract is executed or the first insurance application is submitted.

Best of luck and preparation to you!