What are the chances, right? The other day, out of the nearly clear blue sky, lightning struck my friend’s pool and knocked out their electronic circuit boards, HVAC system and DirecTV. She is lucky the damage wasn’t worse. Well, lucky may not be the right word, but they were fortunate a fire didn’t start and no one was electrocuted. Everything they lost could be replaced and they have homeowners insurance that would cover the losses.

For the fourth consecutive year, the number of lightning-caused U.S. homeowners insurance claims decreased in 2020 yet the average cost of those claims more than doubled since 2017, according to the Insurance Information Institute (www.iii.org).

The number of lightning caused claims fell 6.9 percent to 71,551 claims in 2020 from 76,860 in 2019, while the value of those claims soared 124.6 percent from $920.1 million in 2019 to $2.1 billion in 2020. Lightning-related homeowners insurance claim costs nationally rose dramatically due to a series of lightning strikes across Northern California in 2020, according to the Triple-I. The average cost per lightning claim in California was $217,555 last year while the national average was $28,885 in 2020, up 141.3 percent from $11,971 in 2019.

The Impact of a Lightning Strike (from NationalGeographic.com)

“Lightning is not only spectacular, it’s dangerous. About 2,000 people are killed worldwide by lightning each year. Hundreds more survive strikes but suffer from a variety of lasting symptoms, including memory loss, dizziness, weakness, numbness, and other life-altering ailments. Strikes can cause cardiac arrest and severe burns, but 9 of every 10 people survive. The average American has about a 1 in 5,000 chance of being struck by lightning during a lifetime.

Lightning’s extreme heat will vaporize the water inside a tree, creating steam that may blow the tree apart. Cars are havens from lightning—but not for the reason that most believe. Tires conduct current, as do metal frames that carry a charge harmlessly to the ground.

Many houses are grounded by rods and other protection that conduct a lightning bolt’s electricity harmlessly to the ground. Homes may also be inadvertently grounded by plumbing, gutters, or other materials. Grounded buildings offer protection, but occupants who touch running water or use a landline phone may be shocked by conducted electricity.

What to Expect when filing a claim for lightning damage–from valuepenguin.com

- After you file the claim, an adjuster will inspect the damage to your home.

- If the cost to repair your home exceeds the deductible of your policy, you will need to make a decision whether to file a claim.

- If you choose to file a claim, the adjuster will offer you a settlement for repairs.

- You receive the settlement from your insurance company in two increments. The first half of the settlement to be used to begin making repairs. The second will be for the remaining cost of the repairs after they have been made. “If you are offered an on-the-spot settlement, you can accept the check right away,” Worters says. “Later on, if you find other damage, you can reopen the claim and file for an additional amount.”

- When both your home’s structure and personal property are damaged, you generally receive two separate checks from your insurance company – one for each category of damage. You should also receive a separate check for additional living expenses you might incur if your home in not uninhabitable until repairs are made.

- Note that most policies require claims to be filed within 60 days from the date of disaster.

It is important to note that comprehensive car insurance will cover your car if it’s damaged by a lightning strike. Always a good idea to check your deductible and speak with your agent before filing a claim.

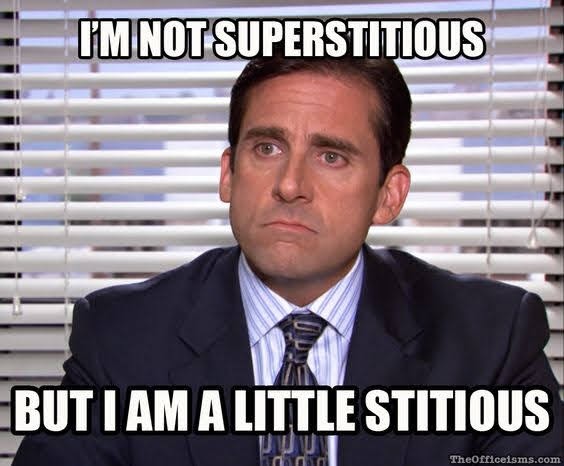

Hopefully, lightning won’t be in the area today. . .or black cats or ladders to walk under or broken mirrors. The scariest thought is not having home or auto insurance to cover you if something unexpected should happen. (I had to say it!)

Happy Friday the 13th, everyone!